Loading

Get Form 8752 Partnership Line 1 - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8752 Partnership Line 1 - IRS online

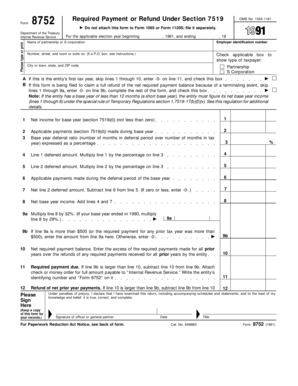

This guide provides a comprehensive overview of how to complete Form 8752 for partnerships and S corporations. It outlines each section clearly to assist users with varying levels of experience in filling out the form accurately and efficiently.

Follow the steps to complete Form 8752 Partnership Line 1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the applicable election year starting and ending dates in the specified fields at the top of the form.

- Provide the name of the partnership or S corporation in the designated section.

- Input the employer identification number in the appropriate field.

- Complete the address section by filling in the number, street, room or suite number, city or town, state, and ZIP code.

- Check the box indicating the type of taxpayer, selecting either Partnership or S Corporation.

- If applicable, check the box for the entity’s first tax year or for a full refund due to a terminating event and follow the specific instructions related to those situations.

- Calculate the net income for the base year and enter this value on Line 1, ensuring it is not less than zero.

- Enter applicable payments for the base year on Line 2 as detailed in the form’s instructions.

- Calculate the base year deferral ratio and enter the percentage on Line 3.

- Multiply the net income by the deferral ratio and complete necessary calculations for lines 4 through 12 as instructed.

- Sign the form, providing the title and date in the signature section, and ensure to keep a copy for your records.

- Once all fields are completed, save changes, and if needed, download, print, or share the form as per your requirements.

Complete your documents online with confidence using these guidelines.

After an installment agreement is approved, you may submit a request to modify or terminate your installment agreement. You may modify your payment amount or due date by going to IRS.gov/OPA. You may also call 800-829-1040 to modify or terminate your agreement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.