Loading

Get 2018 Instructions For Form 1041 And Schedules A, B, G, J ... - ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2018 Instructions For Form 1041 And Schedules A, B, G, J online

This guide provides clear and supportive instructions on filling out the 2018 Instructions For Form 1041 and its associated schedules online. Follow along to ensure accurate completion, making the process as seamless as possible.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory notes and instructions at the beginning of the document to understand its purpose and the sections that need your attention.

- Begin filling out your identifying information, ensuring that all names and numbers match the information on your tax return.

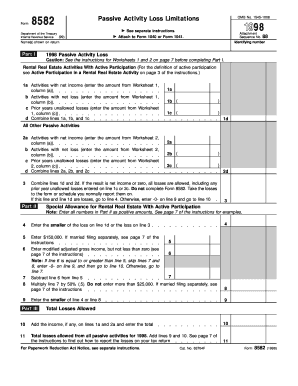

- Navigate to Part I and input details regarding rental real estate activities, including net income, net loss, and prior unallowed losses as per Worksheet 1.

- For all other passive activities, repeat the process in Part II using Worksheet 2 to record the relevant figures.

- In Part III, sum the total losses allowed by combining the figures from earlier sections. Follow the guidelines to report these accurately.

- Review your entries thoroughly to ensure accuracy and compliance with the instructions provided throughout the form.

- Once all sections are complete, use the options available to save changes, download, print, or share the finished form as needed.

Start filling out your documents online today to ensure timely and accurate submissions.

A trust or decedent's estate is allowed an income distribution deduction for distributions to beneficiaries. To figure this deduction, the fiduciary must complete Schedule B. The income distribution deduction determines the amount of any distributions taxed to the beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.