Loading

Get 1993 Form 8582. Passive Activity Loss Limitations - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1993 Form 8582. Passive Activity Loss Limitations - Irs online

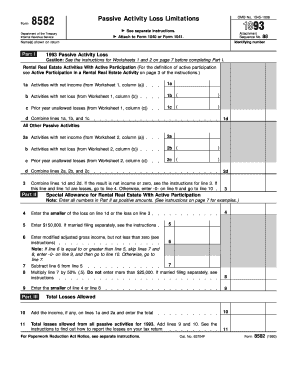

Filling out IRS Form 8582 is essential for taxpayers looking to claim passive activity loss limitations for the 1993 tax year. This guide will provide a clear, step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Provide your name and identifying number as shown on your tax return in the designated fields.

- In Part I, categorize your rental real estate activities with active participation. Report income and losses following the guidance from Worksheets 1 and 2 attached to the form.

- Complete the calculations in Part I by combining the net income, net loss, and prior year unallowed losses as directed.

- Proceed to Part II, ensuring all numbers are entered as positive amounts. Follow the instructions provided to calculate the special allowance for rental real estate.

- In Part III, compute the total losses allowed, combining your allowed losses and any income from passive activities.

- Review all entries for accuracy before finalizing. Ensure your calculations are correct and match any supporting documentation.

- After completing the form, you can save changes, download, print, or share the form according to your needs.

Start filling out your documents online today to ensure timely and accurate submissions.

Passive activity loss rules state that passive losses can be used only to offset passive income. A passive activity is one in which the taxpayer did not materially participate during the year in question. Common passive activity losses may stem from leasing equipment, real estate rentals, or limited partnerships.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.