Loading

Get Form 8281 (rev. May 2005 ) - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 8281 (Rev. May 2005) - IRS - Irs online

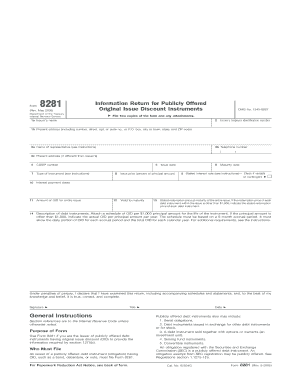

Filling out Form 8281 is a vital step for issuers of publicly offered debt instruments with original issue discount (OID). This guide provides clear, step-by-step instructions for completing the form online, ensuring you meet all necessary requirements.

Follow the steps to fill out Form 8281 accurately.

- Click the ‘Get Form’ button to access the form in an editor.

- Enter the issuer’s name in Box 1a. This should be the official name of the organization or entity issuing the debt instruments.

- Provide the issuer’s taxpayer identification number in Box 2. This number is essential for IRS identification purposes.

- Complete Box 1b with the present address of the issuer, ensuring it includes all relevant details such as street number, city, state, and ZIP code.

- Fill in the name of a representative in Box 3a who is knowledgeable about the offering. Include their telephone number in Box 3b and, if necessary, an alternate address in Box 3c.

- Input the CUSIP number of the financial instruments in Box 4. This unique identifier is crucial for tracking the instruments.

- Specify the type of instrument in Box 7 by selecting from options such as fixed rate, variable rate, or contingent payment.

- Enter the issue date in Box 5 to identify when the instruments were made available to the public.

- Indicate the issue price as a percentage of the principal amount in Box 8. Provide clarification if the percentage is 100 or higher.

- Fill in the maturity date in Box 6 to denote when the instrument will mature.

- List the stated interest rate in Box 9. If the rate is variable, check the appropriate box and explain in Box 14.

- Provide the interest payment dates in Box 10, detailing when interest payments will occur.

- State the amount of OID for the entire issue in Box 11, calculating it from the difference between the issue price and the stated redemption price.

- Enter the yield to maturity in Box 12 as a percentage, ensuring it reflects the expected return on the investment.

- In Box 14, describe the debt instruments thoroughly and attach any necessary schedules detailing the OID per $1,000 principal amount.

- After completing all required fields, review the form for accuracy. You can then save changes, download, print, or share the completed form as needed.

Start filling out your Form 8281 online today to ensure compliance with IRS regulations.

Where to File Forms Beginning with the Number 8 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS: Form 8281, Information Return for Publicly Offered Original Issue Discount Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-020947 more rows • Aug 17, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.