Loading

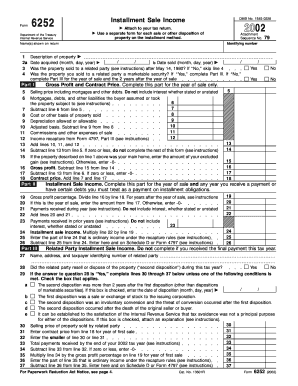

Get Use A Separate Form For Each Sale Or Other Disposition Of Property On The Installment Method

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Use A Separate Form For Each Sale Or Other Disposition Of Property On The Installment Method online

Filling out the Use A Separate Form For Each Sale Or Other Disposition Of Property On The Installment Method can seem complex, but this guide offers clear instructions to help you successfully complete the form online. Each section of the form is outlined with detailed guidance to ensure accuracy and compliance with tax regulations.

Follow the steps to complete the form correctly online.

- Click ‘Get Form’ button to obtain the form and open it in the editor, making it available for filling out online.

- Enter your name(s) as shown on your tax return in the designated area of the form. Ensure to use your official names, as this is crucial for identification purposes.

- Provide the description of the property you sold, including the date you acquired it and the date of sale. Accurate dates and descriptions help clarify your transaction.

- Complete Part I, which includes calculating the gross profit and contract price. Follow the specific line instructions for lines 5 through 14 to report your income accurately.

- Move on to Part II to document the installment sale income. Include payments received during the reporting year, ensuring not to include interest in your calculations. Fill lines 19 through 26, considering previous years' payments where applicable.

- If applicable, complete Part III regarding related party installment sale income. Follow the instructions for lines 30 through 37 as necessary based on your situation.

- Review all entries for accuracy before finalizing the form. It is essential to double-check that all calculations align with your records.

- Once completed, save your changes to the form. You can download or print a copy for your records, or share it electronically as required.

Start filling out your forms online today to ensure timely and accurate submission.

Use 8949 for regular transactions and 4797 for properties with special considerations. Grasping the distinctions is crucial for accuracy, especially for the California tax on sale of a rental property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.