Loading

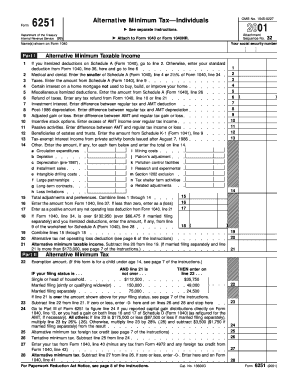

Get 2001 Form 6251. Alternative Minimum Tax - Individuals - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form 6251. Alternative Minimum Tax - Individuals - IRS online

Understanding and completing the 2001 Form 6251, which addresses the Alternative Minimum Tax for individuals, can be crucial for accurate tax reporting. This guide provides step-by-step instructions to help you navigate and fill out the form correctly, ensuring you meet all requirements and maximize your potential deductions.

Follow the steps to effortlessly complete your tax form.

- Click the ‘Get Form’ button to access the 2001 Form 6251 and open it in your preferred document editor.

- Begin by filling out your personal information, including your name as shown on Form 1040, in the designated section at the top of the form.

- Proceed to Part I, where you will calculate your Alternative Minimum Taxable Income. If you itemized deductions on Schedule A, refer to line 2; otherwise, enter your standard deduction from Form 1040 line 36.

- Complete lines 1 through 14 in Part I, entering the respective amounts as instructed using your Schedule A details. This includes medical expenses, taxes, interest deductions, and other adjustments.

- Total the adjustments and preferences on line 15, then follow through lines 18 and 19, noting your net operating loss if applicable.

- In Part II, identify your exemption amount based on your filing status and subtract this from your Alternative Minimum Taxable Income on line 23.

- Multiply the resulting amount by the applicable tax rate (26% or 28%) as instructed in line 24 to determine your tentative minimum tax. Deduct any foreign tax credits if applicable.

- Finalize your calculations and enter the Alternative Minimum Tax amount on line 28. Ensure that this is also noted on Form 1040 line 41.

- Review your filled-out form for accuracy and completeness. Make sure all required attachments are included.

- After confirming that all data is correct, save your changes, and proceed to download, print, or share your completed form as needed.

Take the first step towards a precise tax submission by completing your 2001 Form 6251 online today.

If your income is over the stated level, you're taxed at a rate of 28 percent on the excess income. This means that for a single person who earned more than $75,900 in 2022, but less than $206,100, the AMT rate is 26 percent. If that person earned more than $206,100, the AMT tax rate goes up to 28 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.