Get In Most Cases, You Do Not Need To File Form 2210 - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign In Most Cases, You Do Not Need To File Form 2210 - Irs online

How to fill out and sign In Most Cases, You Do Not Need To File Form 2210 - Irs online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Legal, business, tax as well as other documents need a high level of compliance with the legislation and protection. Our forms are regularly updated according to the latest legislative changes. Plus, with us, all of the information you provide in your In Most Cases, You Do Not Need To File Form 2210 - Irs is well-protected from leakage or damage with the help of industry-leading file encryption.

The tips below will help you complete In Most Cases, You Do Not Need To File Form 2210 - Irs easily and quickly:

- Open the form in the feature-rich online editor by hitting Get form.

- Fill in the required fields which are colored in yellow.

- Click the green arrow with the inscription Next to jump from box to box.

- Go to the e-autograph solution to e-sign the template.

- Insert the relevant date.

- Look through the whole e-document to make sure you haven?t skipped anything.

- Press Done and download your new document.

Our platform allows you to take the whole process of submitting legal forms online. Consequently, you save hours (if not days or weeks) and get rid of additional costs. From now on, fill out In Most Cases, You Do Not Need To File Form 2210 - Irs from home, business office, as well as on the go.

How to edit In Most Cases, You Do Not Need To File Form 2210 - Irs: customize forms online

Put the right document management capabilities at your fingertips. Complete In Most Cases, You Do Not Need To File Form 2210 - Irs with our reliable service that comes with editing and eSignature functionality}.

If you want to execute and certify In Most Cases, You Do Not Need To File Form 2210 - Irs online without hassle, then our online cloud-based option is the ideal solution. We provide a rich template-based catalog of ready-to-use forms you can modify and complete online. In addition, you don't need to print out the form or use third-party options to make it fillable. All the needed tools will be available for your use once you open the file in the editor.

Let’s go through our online editing capabilities and their main features. The editor features a intuitive interface, so it won't require much time to learn how to use it. We’ll take a look at three main sections that allow you to:

- Edit and annotate the template

- Organize your paperwork

- Prepare them for sharing

The top toolbar has the tools that help you highlight and blackout text, without pictures and image factors (lines, arrows and checkmarks etc.), add your signature to, initialize, date the form, and more.

Use the toolbar on the left if you would like to re-order the form or/and delete pages.

If you want to make the template fillable for others and share it, you can use the tools on the right and add different fillable fields, signature and date, text box, etc.).

Aside from the functionality mentioned above, you can protect your file with a password, add a watermark, convert the file to the required format, and much more.

Our editor makes completing and certifying the In Most Cases, You Do Not Need To File Form 2210 - Irs very simple. It allows you to make virtually everything concerning dealing with documents. In addition, we always ensure that your experience modifying documents is protected and compliant with the major regulatory criteria. All these aspects make using our solution even more pleasant.

Get In Most Cases, You Do Not Need To File Form 2210 - Irs, make the needed edits and tweaks, and download it in the preferred file format. Give it a try today!

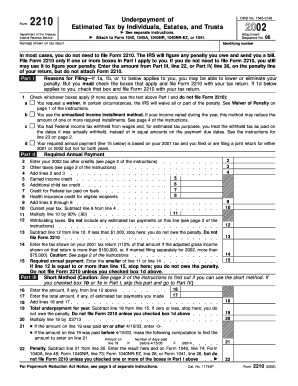

Purpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.