Get Schedule D (form 1120s) Capital Gains And Losses And Built-in Gains

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCHEDULE D (Form 1120S) Capital Gains And Losses And Built-In Gains online

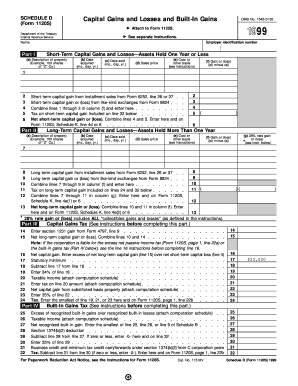

Filling out SCHEDULE D (Form 1120S) is essential for reporting capital gains and losses for S corporations. This guide provides a clear, step-by-step process for completing the form online, ensuring you have the necessary information at your fingertips.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, where you will document short-term capital gains and losses. Provide the description of each asset, its acquisition date, sale date, sales price, cost or other basis, and calculate the gain or loss by subtracting the basis from the sales price.

- Continue filling out Part II for long-term capital gains and losses. Similar to Part I, enter the required information for each asset held for more than one year and calculate the gain or loss.

- In Part III, calculate your capital gains tax. Enter any section 1231 gain and combine it with your net long-term capital gain or loss as directed.

- Move to Part IV, which deals with built-in gains tax. Follow the instructions to calculate the excess of recognized built-in gains over losses and determine the applicable tax amount.

- Once all parts are complete, review your entries for accuracy. After verification, you can save your changes, download, print, or share the completed form.

Complete your SCHEDULE D (Form 1120S) online to ensure accurate reporting of capital gains and losses.

To calculate built-in gains tax, determine fair market value (FMV) of corporate assets (such as real estate or equipment). Next, determine the adjusted basis of the assets, and subtract the adjusted basis from FMV. If the adjusted basis is higher than FMV, the difference qualifies as built-in gains. What is Built-In Gains Tax and How is it Calculated? ESOP Partners https://.esoppartners.com › blog › built-in-gains-tax ESOP Partners https://.esoppartners.com › blog › built-in-gains-tax

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.