Loading

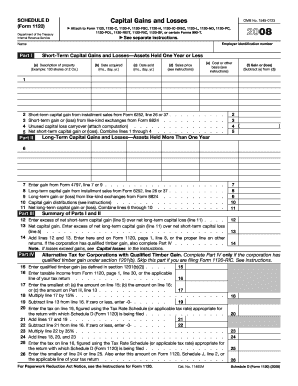

Get Attach To Form 1120, 1120-c, 1120-f, 1120-fsc, 1120-h, 1120-ic-disc, 1120-l, 1120-nd, 1120-pc,

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Attach To Form 1120, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND, 1120-PC, online

Filling out the Attach To Form 1120 and its variants can be a straightforward process when approached step-by-step. This guide is designed to assist you in effectively completing these forms online, ensuring you provide all necessary information correctly.

Follow the steps to successfully complete the Attach To Form 1120 and its variants.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin with entering your employer identification number (EIN) at the top of the form. This number is crucial for identifying your business for tax purposes.

- Next, provide the name of your business as it appears in official records. This ensures your form is associated with the correct entity.

- For Part I, list your short-term capital gains and losses. Fill in the description of the property, along with the dates acquired and sold. Enter the sales price and cost basis for each asset.

- Continue by calculating your gain or loss for each transaction in Part I using the formula provided. Combine these figures to determine your total net short-term capital gain or loss.

- Proceed to Part II, where you will detail your long-term capital gains and losses. Repeat the process as in Part I: provide descriptions, dates, sales prices, and costs.

- Calculate your net long-term capital gain or loss by combining the entries from Part II.

- In Part III, summarize your findings from Parts I and II. Input the excess of net short-term capital gains over long-term capital losses, and vice versa.

- If applicable, complete Part IV, which is only necessary if your corporation has qualified timber gain. Follow the instructions carefully to ensure accurate calculations.

- Finally, review the entire form for accuracy. Once satisfied, you can save your changes, download a copy, print the form, or share it as needed.

Ensure your tax documents are filled out correctly by completing your forms online.

Form 1120-H cannot be filed electronically. See the form instructions for the mailing address based on where the association is located.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.