Loading

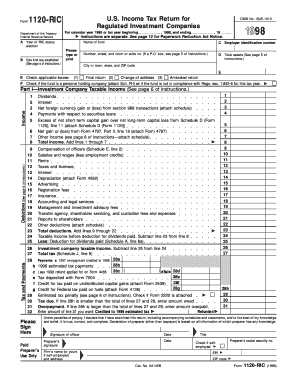

Get 1998 Form 1120ric - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 1120RIC - Irs online

This guide provides a step-by-step approach to filling out the 1998 Form 1120RIC online. It is designed to assist users with varying levels of experience in completing this essential document for regulated investment companies.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the name of your fund in the designated field. Ensure to enter the exact legal name as registered.

- Enter the employer identification number (EIN) for the fund. This number should be formatted correctly as a nine-digit number.

- Input the address of the fund, including street number, city, state, and ZIP code. If using a P.O. box, follow the guidelines specified in the instructions.

- Review the total assets field and enter the accurate total as per the balance sheet. This amount must reflect the assets held at the end of the tax year.

- Select the applicable checkboxes for the fund status – whether it is a final return, a change of address, or an amended return. Additional notes are provided for the context of these selections.

- Proceed to Part I and enter income details. Each source of income, such as dividends and interest, must be listed separately. Calculate the total income by adding lines as directed on the form.

- Enter deductions relevant to the fund's expenses. Each expense category should be listed to ensure full compliance and accurate reporting.

- Calculate the investment company taxable income by subtracting the total deductions from total income. Ensure all calculations are verified.

- Complete the tax and payments section by entering applicable overpaid taxes and any amounts owed. Be diligent about checking each line for accuracy.

- Finally, review all fields for any errors or missing information. Once confirmed, you can save changes, download, print, or share the completed form.

Complete your forms online now for a seamless filing experience.

Purpose of Form Use Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a regulated investment company (RIC) as defined in section 851.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.