Loading

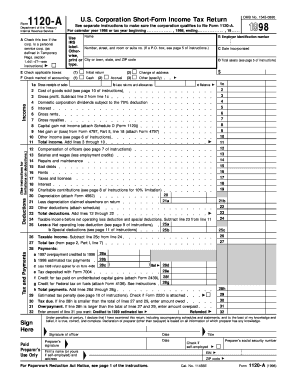

Get 1998 Form 1120 -a - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 1120 -A - IRS online

Filing your U.S. Corporation Short-Form Income Tax Return can be straightforward with the right guidance. This guide will provide you with a clear and supportive approach to completing the 1998 Form 1120 -A - IRS online, ensuring you understand each section and field of the form.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to download the form and open it in the appropriate editor.

- Begin by filling out the basic information about your corporation. Enter your corporation's name, address (including the city, state, and ZIP code), employer identification number, and date of incorporation in the designated fields.

- Check the applicable boxes for your filing situation, such as whether it is an initial return or a change of address, and select the method of accounting (cash or accrual). Ensure you review the instructions to see if your corporation qualifies to file Form 1120-A.

- In Part I—Income, enter your gross receipts or sales in line 1a, and fill out additional income sources such as dividends, interest, and gross rents from lines 4 to 7.

- Continue by calculating your total income on line 11, which is the sum of all income recorded in Part I.

- In the Deductions section, fill out lines 12 through 22 to detail your corporation's expenses, including officer compensation, salaries, depreciation, and other deductions.

- Calculate your total deductions on line 23 and subtract it from your total income to determine your taxable income before any deductions on line 24.

- Proceed to the Tax and Payments section. Fill out lines 26 to 30 to determine the tax liability or potential overpayment, based on prior payments and credits.

- Finally, review the signature section. Ensure the officer signs and dates the form, and if prepared by someone else, include their information as well.

- After completion, save your changes, and download or print the form as required. Ensure all information is accurate before submission.

Complete your 1998 Form 1120 -A - IRS online to ensure compliance and support your business's financial health.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.