Loading

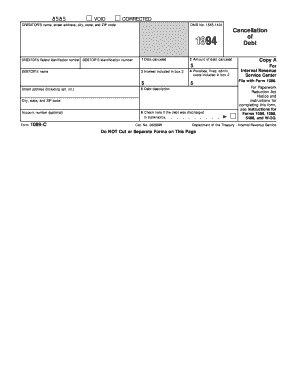

Get Form 1099 -c - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1099-C - IRS online

Filling out the Form 1099-C is an essential task for reporting canceled debts to the Internal Revenue Service. This guide provides a comprehensive overview and step-by-step instructions to help users accurately complete the form online.

Follow the steps to fill out the Form 1099-C online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the creditor’s name along with their street address, city, state, and ZIP code in the designated fields.

- Fill in the creditor's federal identification number next to their name.

- Input the debtor's identification number in the respective field.

- In box 1, indicate the date when the debt was canceled.

- In box 2, write the total amount of the debt that has been canceled, including any associated interest, penalties, and administrative costs.

- If there is any interest included in the canceled debt, enter that amount in box 3.

- Fill in box 4 with the amount of any penalties, fines, or administrative costs included in the canceled debt.

- Provide a description of the debt in box 5, ensuring clarity about the nature of the debt.

- If applicable, check the box in step 6 to indicate that the debt was discharged in bankruptcy.

- Review all entered information for accuracy, then save your changes, and prepare to download, print, or share the completed form.

Complete and file your Form 1099-C online today for a smooth reporting process.

Here's what you need to know: You must send a 1099 when you've made payments to a contractor of $600 or more during the tax year in the course of your trade or business. The contractor must be an individual or partnership. Payments to corporations currently don't require a 1099, except as noted below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.