Loading

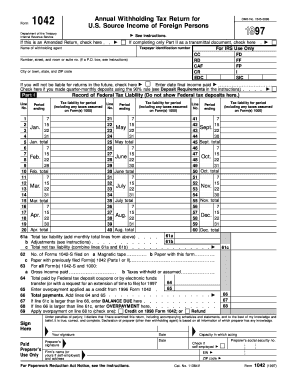

Get If This Is An Amended Return, Check Here - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the If This Is An Amended Return, Check Here - IRS online

Filling out the 'If This Is An Amended Return, Check Here' section of the IRS form is an important step for those needing to update their previously filed tax returns. This guide provides clear, step-by-step instructions to ensure a smooth online completion of this process.

Follow the steps to accurately complete your amended return.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Locate the section marked 'If This Is An Amended Return, Check Here.' This is usually found at the top of the form. If you are amending a return, check this box clearly to indicate that it is an amended submission.

- Complete the required fields under the personal information section. This includes the name of the withholding agent, taxpayer identification number, and the address information. Make sure to double-check for accuracy.

- Proceed to fill out Part I of the form, detailing the tax liability for each period. Follow the form's instructions carefully to input the necessary figures.

- If applicable, complete Part II as a transmittal document by filling in the details of any forms related to the amended return. Do not check this section if you are only amending Part I.

- Review all the information you have entered for accuracy. Ensure that all necessary fields are filled and that you have provided any required attachments.

- Once you have completed the form, you may save the changes. Then, proceed to print the form if a physical signature is needed.

- Finally, submit your completed form as per the IRS guidelines, ensuring it is sent to the correct address provided in the form instructions.

Complete your documents online today to ensure timely updates to your tax filings.

Get your refund on your amended return Enter your bank account information on the electronically filed Form 1040-X or corrected Form 1040-SS/PR. If you submitted a paper version of Form 1040-X, you'll receive a paper check.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.