Loading

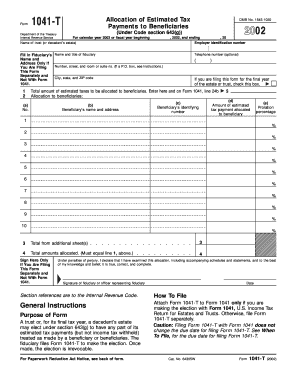

Get 2002 Form 1041t. Allocation Of Estimated Tax Payments To Beneficiaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2002 Form 1041T. Allocation of estimated tax payments to beneficiaries online

Filling out the 2002 Form 1041T is essential for trusts and decedent's estates to allocate estimated tax payments to beneficiaries. This guide will provide you with a step-by-step approach to ensure accurate completion of the form.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- In the top section, fill in the name of the trust or decedent’s estate, followed by the employer identification number and the fiduciary’s name and title.

- Provide the address details including the street number, suite number (if applicable), city, state, and ZIP code. Optionally, include the telephone number.

- If this form is for the final year of the estate or trust, check the box that indicates this.

- Enter the total amount of estimated taxes to be allocated to beneficiaries in Line 1, and remember to include this amount on Form 1041, line 24b.

- In Section 2, list the beneficiaries in the following format: for each beneficiary, enter their name and address (column b), identifying number (column c), and the amount of estimated tax payment allocated to them (column d).

- For column e, calculate the proration percentage for each beneficiary by dividing the amount shown in column d by the total from Line 1.

- If there are more than ten beneficiaries, record additional beneficiaries on a separate sheet, following the same format, and enter the total on Line 3.

- Complete the form by signing under the signature of the fiduciary or the officer representing the fiduciary, and enter the date.

- After ensuring all sections are completed accurately, save your changes, and download, print, or share the form as required.

Start filling out your 2002 Form 1041T online today to allocate estimated tax payments to beneficiaries efficiently.

Though a Canadian trust is not a legal entity, it is considered a taxpayer at the highest rates under Canadian law. 45 That is why trustees try to pass on any income earned by trust property to beneficiaries, so they can pay the taxes at their own, presumably lower, rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.