Loading

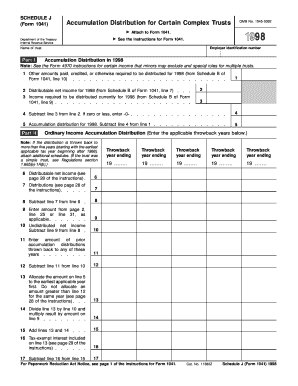

Get 1998 Form 1041 (schedule J). Accumulation Distribution For A Complex Trust - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 1041 (Schedule J). Accumulation Distribution For A Complex Trust - Irs online

Filling out the 1998 Form 1041 (Schedule J) is an essential step for managing accumulation distributions for complex trusts. This guide will provide you with clear instructions to successfully complete the form, ensuring compliance and accuracy in your submissions.

Follow the steps to fill out the 1998 Form 1041 (Schedule J) online.

- To begin, click the ‘Get Form’ button to access the form and open it in your chosen editing tool.

- Enter the name of the trust at the top of the form as required.

- Provide the employer identification number (EIN) for the trust.

- In Part I, report the accumulation distribution amounts. Line 1 requires entering other amounts paid, credited, or required to be distributed for 1998, which can be derived from Schedule B of Form 1041, line 10.

- Line 2 should reflect the distributable net income for 1998, obtained from Schedule B of Form 1041, line 7.

- Line 3 is for reporting the income required to be distributed currently for 1998, also from Schedule B of Form 1041, line 9.

- For line 4, subtract line 3 from line 2. If the result is zero or less, enter '0'.

- Line 5, the accumulation distribution for 1998, is calculated by subtracting line 4 from line 1.

- In Part II, fill in lines 6 to 12, pertaining to ordinary income accumulation distribution. Carefully refer to the provided instructions for calculations relating to throwback years.

- Complete Part III regarding taxes imposed on undistributed net income by following the same protocol for entering amounts as specified in the instructions.

- Finally, move to Part IV to allocate amounts to beneficiaries. Ensure you fill in the beneficiary's name, identifying number, and address details accurately.

- Once all sections are complete, carefully review your entries for accuracy. You can then save your changes, download, print, or share the completed form as required.

Now that you have this guide, start filing your documents online for a seamless experience.

Each works in critically different ways. Estates make a one-time transfer of your assets after death. Trusts, meanwhile, allow you to create an ongoing transfer of assets both before and after death.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.