Loading

Get 1992 Form 1041 (schedule J). Accumulation Distribution For A Complex Trust - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1992 Form 1041 (Schedule J). Accumulation Distribution For A Complex Trust - Irs online

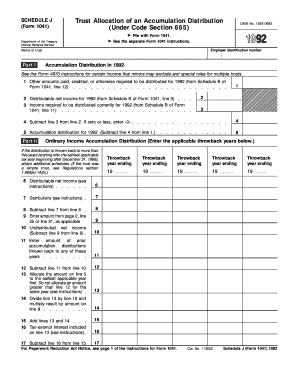

Filling out the 1992 Form 1041 (Schedule J) is essential for complex trusts to report accumulation distributions. This guide will provide you with comprehensive, step-by-step instructions to help ensure accurate completion of the form.

Follow the steps to effectively complete the 1992 Form 1041 (Schedule J)

- Press the ‘Get Form’ button to access the form and open it in your preferred document viewer.

- In the first section, enter the name of the trust and the employer identification number. These are crucial for identifying the entity associated with the form.

- Proceed to Part I. Begin by completing line 1 with the total amounts required to be distributed for the year 1992. This amount can be obtained from Schedule B of Form 1041, specifically line 12.

- On line 2, enter the distributable net income for 1992, which can also be found on Schedule B of Form 1041, line 9.

- Fill line 3 with the income that is required to be distributed currently for 1992, referencing Schedule B of Form 1041, line 11.

- Calculate line 4 by subtracting line 3 from line 2. If the result is zero or less, enter -0-.

- Complete line 5 by calculating the accumulation distribution for 1992, which is the result of subtracting line 4 from line 1.

- Move to Part II and enter the distributable net income on line 6. This should align with previous entries made regarding the trust’s income.

- For line 7, report distributions based on the applicable instructions provided.

- Determine line 8 by subtracting line 7 from line 6.

- Input the appropriate throwback years details where necessary, following the instructions for allocation.

- Complete Part III by addressing any taxes imposed on undistributed net income, using throwback year specifics as needed.

- Finish by allocating amounts to beneficiaries in Part IV, ensuring to complete Form 4970 as directed.

- Once all sections are filled out, you may save changes, download, print, or share the completed form as needed.

Ensure you accurately file the 1992 Form 1041 (Schedule J) online to meet compliance and reporting requirements.

Related links form

File Form 541 in order to: Report income received by an estate or trust. Report income distributed to beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.