Loading

Get Simple Trust Complex Trust - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Simple Trust Complex Trust - IRS online

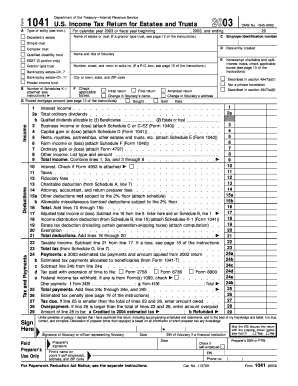

Filling out the Simple Trust Complex Trust form (IRS Form 1041) online can be a straightforward process if you follow the right steps. This guide aims to provide clear and supportive instructions to help users complete the form accurately.

Follow the steps to fill out the form efficiently.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the type of entity: You will need to select whether your entity is a decedent’s estate or a trust. Refer to the instructions if you need guidance on the distinctions.

- Provide the name of the estate or trust in the specified field. If it is a grantor type trust, remember to refer to the relevant instructions on that page.

- Input the employer identification number. This number is crucial for tax identification purposes and must be accurate.

- Include the date the entity was created. This information is necessary for establishing the timeline of the trust or estate.

- Check the appropriate boxes for your trust type, such as simple trust or complex trust. Ensure that you also review additional options for charitable or split-interest trusts.

- Fill in the fiduciary's name and title, which identifies the individual responsible for managing the trust or estate.

- Complete the address section with detailed information, including street, city, state, and ZIP code.

- Proceed to the income section of the form. Enter various types of income, including interest, dividends, business income, and other forms of revenue as required.

- Move on to the deductions section and record all allowable deductions. This includes fiduciary fees, charitable deductions, and any other permissible expenses.

- Calculate the total income and total deductions. Subtract total deductions from total income to arrive at taxable income.

- Provide payment information and determine if there is any tax due or an overpayment after completing the necessary calculations.

- Sign and date the form, confirming its accuracy. If a preparer other than the fiduciary completed the form, they must also sign and provide their information.

- Finally, save the form after completing all sections. You can choose to download, print, or share the form as needed.

Complete your tax documents online today for a simpler filing process.

You must file Form 1041 for a domestic trust that has: Any taxable income for the tax year. Gross income of $600 or more (regardless of taxable income) A beneficiary who is a non-resident alien.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.