Loading

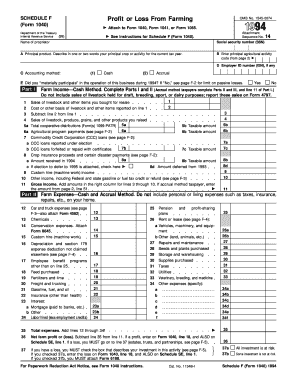

Get 1994 Form 1040 (schedule F). Profit Or Loss From Farming - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1994 Form 1040 (Schedule F). Profit Or Loss From Farming - IRS online

Filling out the 1994 Form 1040 (Schedule F) for profit or loss from farming is an important part of reporting your agricultural income. This guide will walk you through each section of the form, providing clear, step-by-step instructions to ensure accurate completion.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen document editor.

- Enter your name and social security number in the designated fields at the top of the form.

- Indicate your principal product by briefly describing your main crop or activity for the current tax year in box A.

- Fill in the principal agricultural activity code in box B, using the codes listed in Part IV of the form.

- Select your accounting method by checking either the ‘Cash’ or ‘Accrual’ option in box C.

- For Part I, report farm income under the cash method. Start with sales of livestock and items bought for resale in line 1, and continue through line 11 to determine gross income.

- In Part II, report farm expenses for both cash and accrual methods starting from line 12. Calculate total expenses in line 35.

- Calculate your net farm profit or loss by subtracting total expenses from gross income in line 36.

- If you have a loss, check the appropriate box in line 37 to indicate your investment status.

- Review all entries for accuracy before proceeding to save changes, download your completed form, print, or share it as needed.

To manage your documents efficiently, consider completing the required forms online.

Schedule F ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040. If you have a profit or a loss, it gets combined with the other non-farming income reported on your return and increases or reduces your taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.