Loading

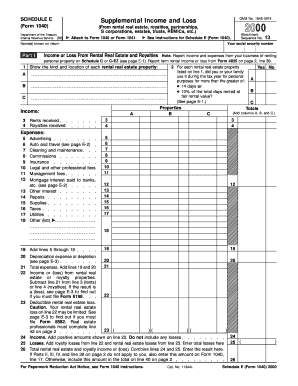

Get 2000 13 Name(s) Shown On Return Your Social Security Number Part I Income Or Loss From Rental Real

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2000 13 Name(s) Shown On Return Your Social Security Number Part I Income Or Loss From Rental Real online

Filling out the 2000 13 Name(s) Shown On Return Your Social Security Number Part I Income Or Loss From Rental Real form is essential for reporting your income or loss from rental properties. This guide provides a clear, step-by-step process to assist you in accurately completing this form online.

Follow the steps to fill out your rental real estate income or loss form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your file editor.

- Enter the names as shown on your tax return in the designated field.

- Provide your Social Security number in the required section.

- In Part I, list each rental property in Section 1, indicating the kind and location for each listed property.

- Report the rent and royalty income received in lines 3 and 4 respectively.

- Indicate whether you or your family used the property for personal purposes more than 14 days or 10% of the rental days in line 2.

- Document all applicable expenses associated with your rental properties in the provided sections, including advertising, cleaning, maintenance, and others.

- Total your expenses in line 19, then add depreciation in line 20.

- Calculate total expenses in line 21 by adding your total from line 19 and line 20.

- Determine your income or loss from rental real estate by subtracting line 21 from the appropriate income line (line 3 or 4). Enter the result in line 22.

- If applicable, provide details for deductible rental real estate losses in line 23 and ensure you are aware of limits on rental losses.

- Summarize the total rental income or losses in line 26, ensuring to follow the instructions for inclusion in Form 1040.

- Review your entries for accuracy and completeness. Save your changes before downloading, printing, or sharing the form.

Complete your rental income reporting online to ensure accurate and timely submission.

If you own rental real estate, you can generate deductions of tens of thousands of dollars to offset other income. If you earn $200,000 from your business and generate $40,000 of losses from rental real estate, this strategy could allow you to pay tax on only $160,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.