Loading

Get 2014 Form 1042-t. Annual Summary And Transmittal Of Forms 1042-s - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Form 1042-T. Annual Summary and Transmittal of Forms 1042-S - IRS online

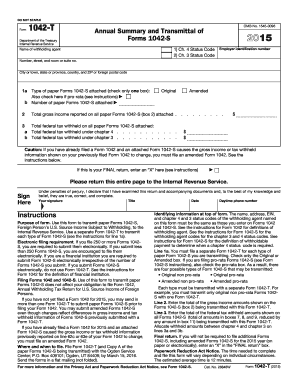

Filing Form 1042-T is essential for transmitting paper Forms 1042-S to the Internal Revenue Service. This guide will provide clear, step-by-step instructions tailored for users at all experience levels, helping ensure that your form is completed accurately and efficiently.

Follow the steps to complete your Form 1042-T accurately.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Fill in the name of the withholding agent, employer identification number, and address, ensuring that these details match those on your Forms 1042 and 1042-S.

- Indicate the type of paper Forms 1042-S attached by checking only one box: Original or Amended. Additionally, if filing pro-rata, check the corresponding box.

- Input the total gross income reported on all attached paper Forms 1042-S into Line 2.

- Enter the total federal tax withheld amounts on Line 3, allocating between chapter 4 and chapter 3 onto lines 3a and 3b respectively.

- If this is your final return, mark the ‘FINAL return’ box by entering an ‘X’.

- Review the form for accuracy. After ensuring all information is correct, you can save changes, download, print, or share the form as needed.

Complete your Form 1042-T online today to ensure compliance and timely submission.

IRS Forms 1099-INT and 1042-S We use Form 1099-INT to report this information for US taxpayers and members without a valid tax certification. For non-US taxpayers with a valid W-8BEN form, we use Form 1042-S. The IRS does not require any action if you receive Form 1042-S.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.