Loading

Get Tsp60 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-60 form online

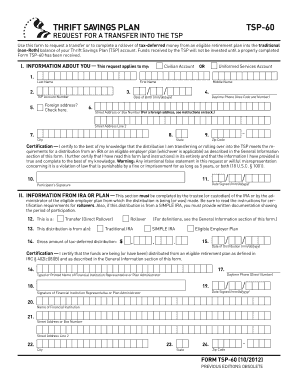

The TSP-60 form is essential for requesting a transfer or rollover of tax-deferred money into your Thrift Savings Plan account. This guide provides clear, step-by-step instructions on how to complete the form online effectively.

Follow the steps to fill out the TSP-60 form online.

- Press the ‘Get Form’ button to access the TSP-60 form and open it in your preferred document editor.

- Begin filling out Section I, which requires personal information. Indicate whether the request applies to your civilian or uniformed services account by selecting one of the options provided.

- Complete personal details including your last name, first name, middle name, date of birth, and contact information, ensuring to provide accurate data to avoid delays.

- If applicable, check the box for foreign address and fill in the street, city, and other location details as specified in the form instructions.

- Read the certification statement carefully. By signing this section, you confirm that the information provided is true and meets transfer requirements. Ensure to sign and date this section accurately.

- Section II must be completed by your IRA trustee or plan administrator. Provide them with the form so they can fill out the necessary information about the transfer or rollover.

- Verify that the form is complete, returning it to your IRA trustee or plan administrator if required for their certification.

- Prepare a check made payable to the Thrift Savings Plan with your name and TSP account number or Social Security number written on the check. Ensure to attach it with the completed form.

- Once the form and check are ready, submit them via mail or fax to the appropriate TSP processing unit as indicated in the instructions.

- After submission, you can save changes to the form in your editor, download a copy, print it for your records, or share it if necessary.

Complete your document online for a smooth transfer into your TSP account.

Age-591/2 Withdrawals If you are 591/2 or older, you can make withdrawals from your TSP account while you are still employed . You must pay income tax on the taxable portion of your withdrawal unless you roll it over to an IRA or other eligible employer plan .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.