Loading

Get 2 I Elect An Arizona Withholding Percentage Of Zero, And I Certify That I Expect To Have - Azdor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2 I Elect An Arizona Withholding Percentage Of Zero, And I Certify That I Expect To Have - Azdor online

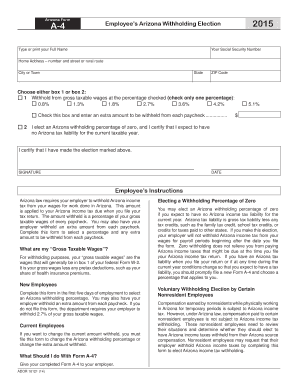

Filling out the 2 I Elect An Arizona Withholding Percentage Of Zero, And I Certify That I Expect To Have form is essential for ensuring accurate tax withholding from your wages. This guide provides clear and user-friendly steps to help you complete the process effectively.

Follow the steps to complete the Arizona withholding form online.

- Press the ‘Get Form’ button to access the Form A-4 and open it for editing.

- Type or print your full name in the designated field.

- Enter your Social Security Number in the appropriate section.

- Provide your home address, including street number and name, city or town, state, and ZIP code.

- Choose between box 1 and box 2. If you want to select a specific withholding percentage, check one of the percentages listed under box 1 (ranging from 0.8% to 5.1%) and, if applicable, enter any additional amount you wish to withhold.

- If you are electing an Arizona withholding percentage of zero, check the box indicating this choice, confirming that you expect to have no Arizona tax liability for the current taxable year.

- Certify your election by providing your signature and the date in the designated fields.

- Once you have filled out the form completely, review your entries for accuracy, then save any changes, and prepare to print or share the document as necessary.

Complete your Arizona tax withholding form online today to ensure proper management of your tax liabilities.

The state income tax rates range from 2.59% to 4.50%, and the sales tax rate is 5.6%, and an average local sales tax rate of 2.8%. Arizona state offers tax deductions and credits to reduce your tax liability, including a standard and itemized deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.