Loading

Get 211 055 2015 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 211 055 2015 Form online

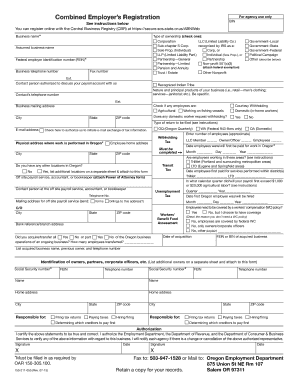

Filling out the 211 055 2015 Form online is an essential step for businesses registering with the Central Business Registry. This guide provides a straightforward approach to completing each section of the form, ensuring you can easily provide the necessary information.

Follow the steps to complete the 211 055 2015 Form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your business name in the designated field. Ensure that the name is accurate and matches your legal documents.

- Select the type of ownership by checking the appropriate box. Options include Corporation, LLC, Sole Proprietorship, and others. Be sure to select the classification that accurately reflects your business structure.

- Provide your Federal Employer Identification Number (FEIN) if applicable. This may be necessary for tax reporting.

- Fill in your business and contact information, including telephone and fax numbers, as well as the name of a contact person who is authorized to discuss your payroll account.

- Detail the nature and principal products of your business. Be specific about the types of services or products offered to provide a clear description.

- Indicate if any of your employees perform agricultural work or are working on fishing vessels by checking the relevant boxes.

- If any domestic worker requests withholding, mark 'Yes' and provide the necessary details.

- Select the type of tax return you plan to file and provide your email address if you wish to authorize the initiation of e-mail exchange of tax information.

- Complete the physical address where work is performed in Oregon, including the city, state, and ZIP code.

- If applicable, list any additional locations in Oregon on a separate sheet and attach it to your form.

- Indicate the date when employees were first paid for work in Oregon and the approximate number of employees.

- Fill in information regarding any previous business acquisitions or transfers, including the number of employees transferred.

- Enter details about workers' compensation insurance and any additional business owners or partners on a separate sheet if necessary.

- Review all entries for accuracy and completeness before signing the form in the designated area.

- Once you have confirmed that all information is correct, you can save changes, download, print, or share the completed form as required.

Take the next step to complete your registration and file the 211 055 2015 Form online today.

Paid Leave Oregon Benefits for Family or Safe Leave should be issued on a Form 1099-G. Paid Leave Oregon Benefits for Medical Leave should be issued on a Form 1099-MISC. Paid Leave Oregon Benefits paid by an employer under an Equivalent Plan for Family, Safe, or Medical Leave benefits should be issued on a Form W-2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.