Get Bt Summary 2009 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bt Summary 2009 form online

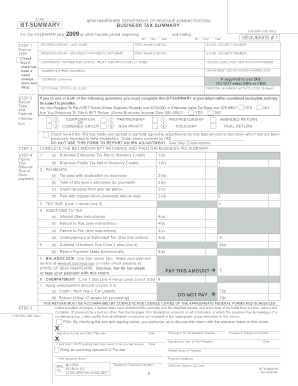

Filling out the Bt Summary 2009 form online is an essential task for individuals and businesses required to report their business taxes. This guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete your Bt Summary 2009 form.

- Press the ‘Get Form’ button to acquire the document and open it for editing.

- Complete the return type and federal information sections, including your name, social security number, and federal employer identification number if applicable.

- Fill out the principal business activity code and provide your complete address, ensuring all details are accurate.

- Answer the questions regarding the requirement to file a BET return or a BPT return. If either applies to your situation, it is necessary to complete the Bt Summary form or face possible penalties.

- Calculate your tax liability by filling in the amounts for Business Enterprise Tax and Business Profits Tax, ensuring you consider any statutory credits.

- Detail your payments made during the year, including any credits carried over from previous periods.

- Determine your balance due or overpayment by performing the necessary calculations as instructed on the form.

- Review and sign the form. Ensure all required signatures are present, including both parties for joint returns.

- Save your changes, then download or print the completed form for your records. You can submit it by mail as indicated or make any payments online.

Complete your Bt Summary 2009 form online today to ensure timely compliance!

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers). New Hampshire and NH Individual Income Tax Return Information - eFile efile.com https://.efile.com › efile-new-hampshire-income-tax... efile.com https://.efile.com › efile-new-hampshire-income-tax...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.