Loading

Get Va Cfda-945a 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA CFDA-945A online

The VA CFDA-945A is a vital form for reporting direct contributions exceeding $100. This guide provides clear, step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to successfully complete the VA CFDA-945A.

- Press the ‘Get Form’ button to obtain the VA CFDA-945A and open it in your preferred digital editor.

- Begin with the reporting period section, entering the start and end dates clearly. Ensure that this information is legible and correct.

- In the candidate information section, provide the full name of the candidate, the candidate's committee, or the political committee in the designated space.

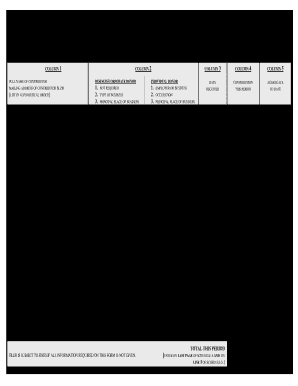

- Under Column 1, list contributors in alphabetical order. Record the full name of each contributor, including individual donors or business/corporate donors.

- Fill out the mailing address and ZIP code for each contributor. Double-check this information for accuracy.

- For each contributor in Column 2, indicate the type of business and the principal place of business if required.

- In Columns 3 to 5, enter the date of contribution, the amount received, and the total aggregate. This includes all contributions made during the reporting period.

- Complete the occupation and principal place of business for each contributor as listed in Columns 4 and 5.

- Upon completion, review the entire form for completeness and accuracy. Ensure that all required information is filled out.

- Finally, save your changes. You may have options to download, print or share the completed form as needed.

Start filling out the VA CFDA-945A online today to ensure compliance and accurate reporting.

To achieve 100% VA disability with a Permanent and Total (P&T) rating, you need to demonstrate that your disability significantly impacts your ability to work. This often requires thorough medical documentation and possibly assistance from veterans' organizations. Understanding the VA CFDA-945A during your application process can be crucial in aligning with the criteria set by the VA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.