Loading

Get Borrowing Money Applications Sample Documents: Two ... - Findlaw

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Borrowing Money Applications Sample Documents: Two Promissory Notes online

Filling out a borrowing money application can be a straightforward process when you have the right guidance. This guide provides step-by-step instructions to help you complete the Borrowing Money Applications Sample Documents: Two Promissory Notes accurately and effectively.

Follow the steps to efficiently complete your borrowing money application.

- To begin, press the 'Get Form' button to obtain the Borrowing Money Applications Sample Documents. This will allow you to open and access the form for completion.

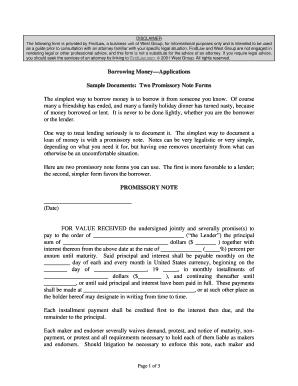

- Start by entering the date at the top of the form where indicated. This will serve as the official date of the agreement.

- In the first promissory note, input the name of the lender in the provided space. This identifies the individual or entity lending the money.

- Next, fill in the amount of money being borrowed in both written form and in numbers. Accuracy in this step is crucial to prevent any misunderstandings.

- Specify the interest rate applicable to the loan. This should be based on what has been agreed upon between the borrower and lender.

- Indicate the payment schedule, including the specific day each month payments will be made, and the starting date of payments.

- Fill in the address where payments will be sent or any other place designated by the lender.

- Each party involved, including any witnesses, should sign and date the form in the relevant sections to validate the agreement.

- After completing the form, ensure to save your changes. You can then download, print, or share the completed document as needed.

Start filling out your borrowing money applications online today for a smooth process.

At a minimum, your loan contract should include: Your name and the borrower's name. The date the loan was granted. The amount of money being lent. Minimum monthly payment. Payment due date. Interest rate, if you're charging interest. Consequences for defaulting on the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.