Loading

Get Tx Worksheet 6 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Worksheet 6 online

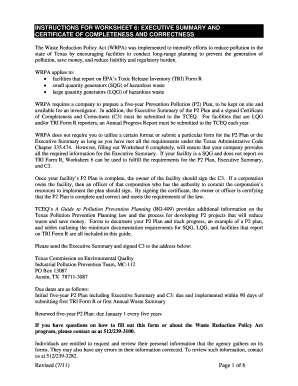

This guide provides comprehensive instructions for completing the TX Worksheet 6, which is required under the Waste Reduction Policy Act. Follow these steps to ensure that you accurately fill out the form online and submit the necessary documentation efficiently.

Follow the steps to successfully complete the TX Worksheet 6

- Click the ‘Get Form’ button to access the TX Worksheet 6 and open it in a digital format for editing.

- Begin with Executive Summary, Part 1: Facility Information. Fill in your company name, facility name, mailing address, and physical address. If the mailing address is the same as the physical address, simply write 'same'. Then, provide the city, state, zip code, county, WRPA contact, and their contact information.

- In Executive Summary, Part 2: Facility's Generation Amount, list the amount of all hazardous waste generated for the pertinent year. This data should be sourced from your latest Annual Waste Summary form. Include descriptions of the waste and the corresponding TX waste code number, as well as the amount generated in tons.

- List all reportable TRI chemicals along with their CAS numbers and the amounts released or transferred for that year based on your most recent TRI Form R. Ensure accuracy based on this form's data.

- Provide a prioritized list of pollutants and contaminants that you aim to reduce during the five-year period. Be clear about the goals you are trying to achieve.

- In the P2 Projects and Goals section, state measurable reduction goals. Explain the environmental and human health risks considered in setting these goals.

- Compile a list of pollution prevention projects along with their implementation schedule. Specify click-through details of how you aim to implement future reduction goals.

- Identify any instances where source reduction or waste minimization might lead to the release of different pollutants or contaminants, or shift releases to another medium.

- Finally, review the Certificate of Completeness and Correctness section. Ensure the document is signed by someone with the authority to commit the facility's resources, such as a facility owner or corporate officer. Provide their name, title, and date of signing.

- After filling out all sections, save the changes. You may choose to download, print, or share the completed form as needed.

Complete the TX Worksheet 6 online today and ensure compliance with the Waste Reduction Policy Act.

Some post offices provide tax forms during the tax season, but availability may vary by location. If you're visiting your post office, it’s a good idea to call ahead to ensure they have what you need. For online resources, the US Legal platform includes tools and forms like the TX Worksheet 6, ensuring you can fill it out without needing to visit a physical location.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.