Loading

Get Mortgage Servicing Regulation X Final Rule - Amendments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Servicing Regulation X Final Rule - Amendments online

This guide provides a clear and supportive overview of how to efficiently complete the Mortgage Servicing Regulation X Final Rule - Amendments form online. It outlines each section and field with concise instructions to assist all users, including those with limited legal experience.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

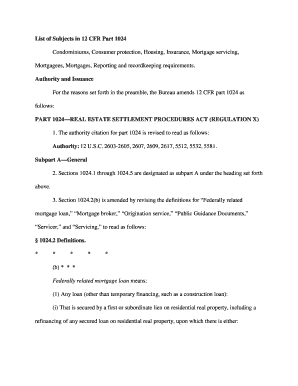

- Review the general section, ensuring you understand the definitions of key terms such as 'Federally related mortgage loan,' 'Servicer,' and 'Servicing.' This will set the context for the information you need to provide.

- Fill out your personal information in the designated fields. This typically includes your name, contact information, and any relevant identifiers associated with your mortgage.

- Proceed to the sections detailing specific mortgage information. Input the necessary details, including loan numbers and descriptions of any related mortgage products.

- If applicable, complete any sections that address servicing transfers. Be prepared to include information on both the current and new servicers, including their contact details.

- Review the disclosure requirements outlined in the form, ensuring compliance with the Electronic Signatures in Global and National Commerce Act. Confirm your eligibility for electronic submissions.

- Complete all required fields regarding loss mitigation options if applicable to your situation. Make sure to specify the outcomes you desire and the preferred options.

- Revisit all sections for accuracy, ensuring you have filled in all mandatory fields.

- Save your changes and check the option to download, print, or share the completed form as necessary. Make sure to keep a copy for your records.

Complete your documents online to ensure compliance and facilitate efficient processing.

RESPA only applies to certain home loans. Reg Z applies to all consumer credit. RESPA is about disclosing fees. Reg Z is about stating key terms (not just fees) and the APR (cost of credit).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.