Loading

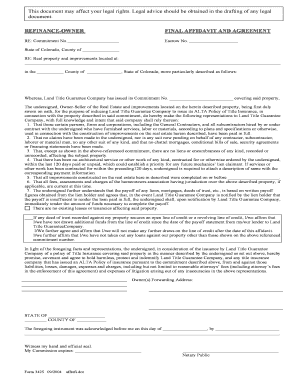

Get Refinance-owner Final Affidavit And Agreement This ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the refinance-owner final affidavit and agreement online

Filling out the refinance-owner final affidavit and agreement is an essential step in facilitating your refinancing process. This guide will provide you with step-by-step instructions to ensure that you complete the form correctly and efficiently online.

Follow the steps to complete your form accurately and effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the commitment number in the designated field at the top of the form. This number is crucial for identifying your specific refinancing case.

- Fill in the escrow number following the commitment number. This number is usually provided by your title company.

- Indicate the state and county where the real property is located. Be precise with this information to avoid any discrepancies.

- Provide the full address of the real property, including any improvements that may have been made. Ensure accuracy to prevent future legal issues.

- In the section regarding payments to contractors and subcontractors, affirm that all relevant parties have been compensated in full.

- State whether there are any pending claims or lawsuits from contractors, subcontractors, or other parties related to the property.

- Disclose any liens or encumbrances on the property. This is vital to ensure there are no future claims against your property.

- If applicable, confirm that all homeowners association fees are up to date.

- Sign and date the document, and if required, provide your forwarding address.

- Finally, ensure that the notary public acknowledges the document as required, by signing and sealing it.

- Once you have completed the form, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your refinancing documents online today to ensure a smooth transaction.

Another instance in which a deed may need to be changed is if you refinance your home. In a refinance, the lender will record a new lien against the property. Deeds can also sometimes need to be changed due to clerical errors or a change in ownership.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.