Loading

Get Canada Business Consent Form - Saskatchewan 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Business Consent Form - Saskatchewan online

Filling out the Canada Business Consent Form - Saskatchewan online is a straightforward process, allowing users to manage consent for the release of tax information efficiently. This guide provides clear, step-by-step instructions tailored for individuals who may have little experience with legal documents.

Follow the steps to complete your consent form seamlessly.

- Click the ‘Get Form’ button to obtain the form and access it in your preferred online editor.

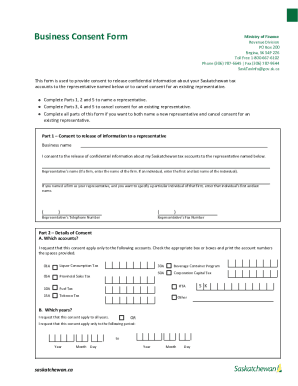

- In Part 1, provide your business name and consent to release confidential information to the intended representative by filling in their name. If applicable, specify an individual within a firm.

- In Part 2, specify the details of consent. Indicate which tax accounts the consent applies to by checking the appropriate box(es) and entering the account numbers. Also, select whether this consent is for all years or a specific period by providing the years and dates.

- If you wish to cancel an existing representative, complete Part 3 by providing your business name and the name of the relevant representative. If it’s a firm, specify the individual within that firm.

- In Part 4, detail the cancellation by indicating which accounts the cancellation will apply to, similar to Part 2. Check the appropriate box(es) and provide account numbers. Select whether the cancellation applies to all years or to a specific period.

- Complete Part 5 by printing your name, title, and providing your telephone number. Ensure that the form is signed by an authorized person such as an owner, partner, director, or officer.

- Once all parts are completed, you can save the changes, download the form, print it, or share it as needed before submitting.

Start filling out your business consent form online today to efficiently manage your tax account authorizations.

There are some goods and services that are still PST exempt such as Life Insurance premiums, land, Residential rent, lawn and snow care services and most groceries remain PST exempt. Saskatchewan PST is not to be charged on goods and services provided to consumers(businesses) outside of Saskatchewan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.