Loading

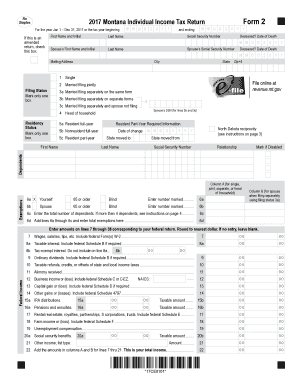

Get Mt Form 2 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT Form 2 online

Filling out the MT Form 2 online can be a straightforward process if you follow the right steps. This guide provides detailed instructions on how to complete each section of the form, ensuring that you submit accurate information to the Montana Department of Revenue.

Follow the steps to successfully complete the MT Form 2 online.

- Press the ‘Get Form’ button to obtain the form and access it in your online editing tool.

- Begin by entering your last name, first name, and initial in the appropriate fields, along with your Social Security Number. If this is an amended return, make sure to check the designated box.

- Provide your mailing address, including city, state, and ZIP+4 code. Ensure that the entered information is current and correct.

- Select your filing status by marking only one of the choices presented: single, married filing jointly, head of household, etc.

- Indicate your residency status by selecting the box that applies to you: full-year resident, part-year resident, or full-year non-resident.

- Complete the exemptions section by entering your age if you are 65 or older, marking if you are blind, and listing the total number of dependents.

- Fill in the income section by entering amounts from your federal return into the corresponding fields, rounding to the nearest dollar.

- Calculate your total income by adding the amounts from the income lines and entering the result in the designated field.

- Follow the instructions to compute your adjusted gross income by considering applicable deductions and adjustments.

- Determine your taxable income by subtracting the exemptions from your total adjusted gross income. Fill out the corresponding fields accurately.

- Enter your tax details, including applicable credits, and calculate your total tax due or refund. Make sure to include all relevant information.

- If applicable, indicate your preference for direct deposit of your refund and provide the necessary banking information.

- Review your completed form for accuracy, then save your changes, and either download, print, or share the form as needed.

Complete your documents online today to ensure timely filing and compliance with state regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Who is eligible to file ITR-2 for AY 2021-22? Do not have income from profit and gains of business or profession and also do not have income from profits and gains of business or profession in the nature of: interest. salary.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.