Loading

Get Uk Apss263 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK APSS263 online

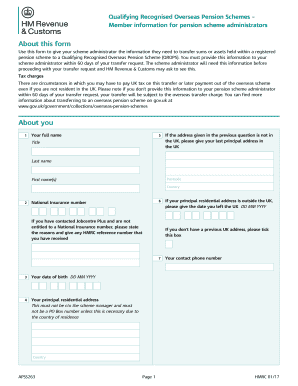

The UK APSS263 form is essential for transferring sums or assets from a registered pension scheme to a Qualifying Recognised Overseas Pension Scheme (QROPS). This guide provides clear and systematic instructions for completing the form accurately.

Follow the steps to fill out the UK APSS263 online

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your full name in the designated fields, ensuring first and last names are clearly stated.

- Provide your date of birth in the format DD MM YYYY.

- Enter your principal residential address, ensuring it is not a care of address or a PO Box unless required due to your country of residence.

- If your principal residential address is outside the UK, indicate the date you left the UK in the format DD MM YYYY.

- Supply your National Insurance number. If you do not have one, explain the reason and include any HMRC reference number received.

- Complete the section regarding the QROPS receiving the transfer. Begin by entering the QROPS reference number and responding to whether it is an occupational pension scheme.

- List the name and address of the QROPS.

- Indicate the country in which the QROPS is established and regulated.

- Provide details about your employment, including the name of your employer, your job title, and the employer's address.

- Complete your employment details by stating the date your employment began in the format DD MM YYYY.

- Answer the question regarding your payroll tax reference number, selecting whether you know it or not.

- Complete the acknowledgment section, confirming whether you have been informed about accessing the value of the transfer prior to reaching age 55.

- Sign and date the form, certifying that the information provided is correct and complete.

- Finally, save your changes, download, print, or share the completed form as needed.

Complete your UK APSS263 form online for a smooth pension transfer process.

Can I transfer my pensions from another country to the UK? It is possible to transfer into a registered UK pension scheme from an overseas (non-UK) pension scheme. But it will depend on the terms of the pension scheme you want to transfer into as to whether they want to accept the transfer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.