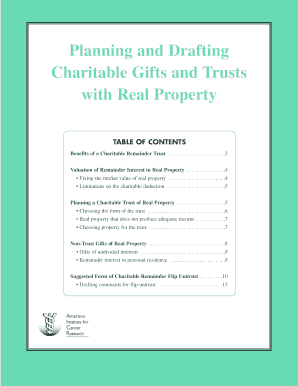

Get Planning And Drafting Charitable Gifts And Trusts With Real Property

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Planning And Drafting Charitable Gifts And Trusts With Real Property online

Filling out the Planning And Drafting Charitable Gifts And Trusts With Real Property form can be an essential step in managing charitable gifts effectively. This guide will provide you with detailed, step-by-step instructions to ensure a thorough understanding of each section of the form.

Follow the steps to complete your form accurately...

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by filling out the donor's information. This includes the name, contact details, and any relevant identifiers required for the charitable trust.

- Next, provide details regarding the real property being contributed. Include the property type, address, and any pertinent identification numbers, such as tax parcel numbers.

- Complete the section regarding the beneficiaries of the trust. Include their names and their relationship to the donor. Ensure that you also specify the income distribution plan.

- Fill in the trust type selection. Determine whether it will be an annuity trust, unitrust, or any other specific form of charitable remainder trust.

- Document the valuation details. Provide a qualified appraisal of the real property, detailing the method of valuation used and including any supporting documents required.

- Check any additional provisions you may wish to include. This could be related to special terms for managing the trust, additional contributions, or unique distribution requests.

- Review all completed sections for accuracy. This is critical to ensure compliance with legal and tax requirements.

- Finally, save your changes. You may download a copy, print it for your records, or share the completed form with relevant parties as necessary.

Take the next step in your charitable planning by completing your documents online today.

Charitable remainder annuity trusts may only be funded once and do not allow future additional contributions to the trust. Charitable remainder unitrusts distribute a unitrust amount each year to income beneficiaries, which is a fixed percentage of the value of the assets at the beginning of each calendar year. Charitable Remainder Trust | Taxation & Distribution Rules - Reninc.com reninc.com https://.reninc.com › charitable-remainder-trust reninc.com https://.reninc.com › charitable-remainder-trust

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.