Loading

Get Temp Id Or Uin Request - Payroll Services

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Temp ID Or UIN Request - Payroll Services online

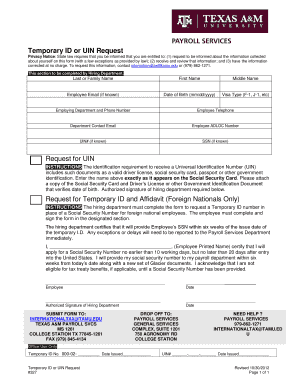

Filling out the Temp ID or UIN Request form is a crucial step for individuals needing identification for payroll services. This guide will provide you with a step-by-step approach to completing the form efficiently and accurately, ensuring that you meet all requirements.

Follow the steps to complete the Temp ID or UIN Request form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your last or family name in the designated field, ensuring it is spelled correctly.

- Fill in your first name and middle name, if applicable, in the respective fields.

- If you have an employee email, enter it in the corresponding field. If this information is not known, you may leave it blank.

- Enter your date of birth in the format mm/dd/yyyy. Ensure this matches your identification documents.

- Select your visa type from the options provided, such as F-1 or J-1.

- Fill in your employing department along with a contact phone number.

- Provide your employee telephone number.

- Input the department contact email address.

- If you have it, enter your employee ADLOC number.

- If known, include your UIN (Universal Identification Number) in the appropriate field.

- If available, input your Social Security Number (SSN) accordingly.

- In the Request for UIN section, ensure to attach a copy of your Social Security Card and Driver’s License or another valid government identification that verifies your date of birth.

- For foreign nationals, complete the Request for Temporary ID and Affidavit section by signing and dating the form after certification that you will apply for an SSN within the required timeframe.

- Ensure that the authorized signature of the hiring department is provided, including the date.

- Review all the information entered for accuracy and completeness.

- Save changes, download, print, or share the form as necessary to complete your submission.

Complete the Temp ID or UIN Request form online today to ensure your payroll services are processed without delay.

Check your CRA account You or your representative can sign in to your online account to confirm CRA account payments and balances. Before checking to see if the CRA has received a payment you sent, allow: 3 business days for online payments. 10 business days (plus mailing time) for payments by cheque or money order.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.