Loading

Get Tx Fpm 2002-01 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX FPM 2002-01 online

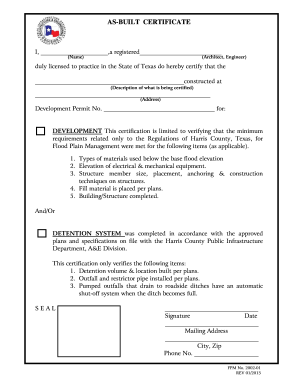

Completing the TX FPM 2002-01 form is essential for certifying compliance with flood plain management regulations in Harris County, Texas. This guide will provide you with clear, step-by-step instructions to fill out the form accurately and efficiently online.

Follow the steps to complete the TX FPM 2002-01 form effectively.

- Press the ‘Get Form’ button to access the TX FPM 2002-01 form and open it in your preferred editor.

- In the first section, provide your name as the certified individual. Fill in the blanks with your full name and the title you hold (e.g., Architect or Engineer).

- Next, enter the description of the project you are certifying. Be specific to ensure clarity for all parties involved.

- Indicate the complete address of the construction site, including street number, name, city, and postal code.

- Fill in the development permit number related to the certification. This number is crucial for identification and verification purposes.

- Review the items that you are certifying against the minimum requirements for flood plain management. Mark or list the applicable items pertaining to materials, equipment elevations, structural details, and completion status.

- If applicable, provide verification details for the detention system, including compliance with approved plans, detention volume, outfall and pipe installations.

- After filling in all sections, ensure you sign the document where indicated and date it. This constitutes your official certification.

- Finally, provide your mailing address, city, zip code, and phone number for future communication. Once complete, save your changes and download, print, or share the form as needed.

Complete your documentation online today for hassle-free submission and compliance.

Filing small business taxes in Texas involves understanding the TX FPM 2002-01 criteria. First, determine your business structure and the applicable tax forms. You can manage your taxes by using an online service or platform like uslegalforms to help with document preparation. Always keep detailed records of your income and expenses to facilitate accurate reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.