Get Tx Form 37a - Harris County 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

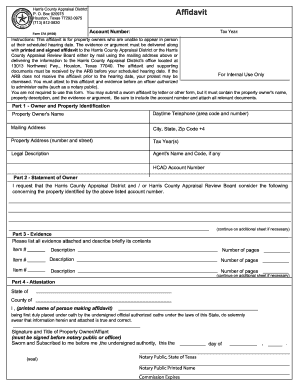

How to fill out the TX Form 37A - Harris County online

Filling out the TX Form 37A for Harris County can be straightforward when you follow the right steps. This guide will lead you through each section and field of the form, ensuring that you are well-prepared and confident in your submission process.

Follow the steps to successfully complete the TX Form 37A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the account number assigned to your property. This number is crucial for identifying your specific property in the Harris County Appraisal District records.

- Next, provide the tax year for which you are submitting this affidavit. Ensure that you select the correct year as this information must correspond with your appraisal protest.

- In Part 1, fill in your personal details including your full name, daytime telephone number, and your complete mailing address including city, state, and zip code.

- Then, enter the property address, the legal description of the property, and, if applicable, the name and code of your agent (if you are being represented). Be sure to also include your HCAD account number.

- Proceed to Part 2, where you must state your request clearly. This section allows you to explain the nature of your protest to the Harris County Appraisal District and/or Appraisal Review Board regarding the property.

- For Part 3, list all evidence that you are attaching in support of your claim. Provide a brief description of the contents for each item, including the number of pages for documentation. Continue on an additional sheet if necessary.

- In Part 4, complete the attestation section. Print your name, confirm your place of residence, and sign the affidavit before a notary public or an authorized officer. Make sure to note the date of signing and include the notary’s printed name and commission expiration date.

- Finally, review the form for accuracy, then save your changes. You can choose to download the completed form, print it for your records, or share it as needed.

Complete your TX Form 37A online today and ensure your property concerns are heard.

Get form

To remove a homestead exemption in Harris County, a property owner must submit a written request to the Harris County Appraisal District. Ensure you include your account number and relevant details to expedite the process. While it may not require much effort, using the guidelines from TX Form 37A - Harris County can help in submitting your request accurately. Removing the exemption will mean an adjustment to your property tax liability.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.