Loading

Get Tx B-ap-117-t-1 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

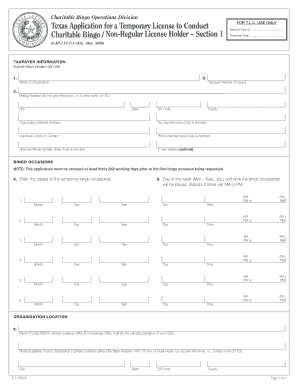

How to fill out the TX B-AP-117-T-1 online

Filling out the TX B-AP-117-T-1 form online can seem daunting, but with this comprehensive guide, you can navigate the process with confidence. This guide provides clear, step-by-step instructions to help you complete the application for a temporary license to conduct charitable bingo.

Follow the steps to successfully complete your TX B-AP-117-T-1 application.

- Click the ‘Get Form’ button to retrieve the TX B-AP-117-T-1 form and open it in the editor.

- Begin by filling in the taxpayer information. Include the name of your organization, taxpayer number (if issued), mailing address, city, state, ZIP code, county, organization website address, fax number, the contact individual's name, phone numbers, and optional email address. Ensure all entries are clear and accurate.

- Specify the bingo occasions by entering the date(s) when the events will occur. Fill in the day of the week and time for each occasion, indicating whether the time is in the AM or PM.

- Provide the organization’s primary business office name and physical address. If there is no business office, indicate the principal residence of the CEO. Enter the city, state, ZIP code, and county.

- List the playing location details by entering the name and full street address of where the bingo games will be conducted. Again, avoid using directions in your address. Include city, state, ZIP code, county, and the contact phone number for this location.

- Respond to questions related to the playing location's proximity to the organization’s primary business office and whether this location is within city limits.

- Provide information on how the location is controlled by your organization, either as owned or leased. If leased, enter the lessor’s details including their taxpayer number and mailing address.

- Calculate and enter the required license fee based on the number of occasions being applied for, at a rate of $25 per occasion. Ensure that the total fee due is accurate.

- Complete the operator section by entering the active member's details who will supervise the bingo operations, including their name, social security number, driver’s license number, home address, and contact information.

- Fill in the bingo chairperson’s information, including their name, social security number, address, and position held within the organization.

- Answer the certification questions regarding previous licenses held at the playing location, and complete any necessary certificates from the county clerk or city secretary.

- Finally, certify the application by correctly signing and dating where indicated by the bingo chairperson and the operator. Review the document for any errors before proceeding.

- Once all sections are completed and verified, save your changes. You can then download, print, or share the filled-out form as needed.

Start filling out your TX B-AP-117-T-1 application online today to make your charitable bingo event a success!

Sales tax exemptions in Texas typically apply to nonprofit organizations, certain governmental entities, and purchases made for reselling. It is crucial to understand the specific criteria outlined by the Texas Comptroller's office. Utilizing your TX B-AP-117-T-1 can help you gather the necessary documentation for applying for an exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.