Loading

Get Pa Pa-8879p 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PA-8879P online

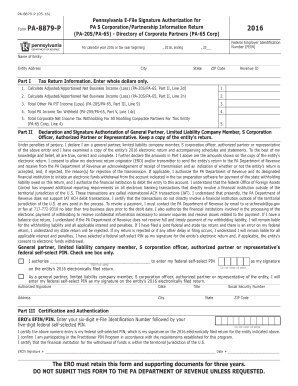

The PA PA-8879P is a form used in Pennsylvania to authorize electronic signatures for the PA S Corporation/Partnership Information Return. This guide will provide you with clear, step-by-step instructions to help you accurately fill out this form online, ensuring compliance with Pennsylvania tax regulations.

Follow the steps to complete the PA PA-8879P online.

- Press the ‘Get Form’ button to obtain the PA PA-8879P and open it in your preferred online editor.

- Enter the calendar year and the entity’s Federal Employer Identification Number (FEIN) in the designated fields.

- Complete the entity's name and full address, including city, state, and ZIP code.

- In Part I, accurately input the amounts for the Adjusted/Apportioned Net Business Income (Loss) and Total Other PA Personal Income Tax (PIT) Income based on the existing tax return.

- Verify and enter the Total PA Income Tax Withheld and Total Corporate Net Income Tax Withholding for All Nonfiling Corporate Partners in Part I.

- In Part II, the authorized person must verify the signature authorization and check the appropriate box regarding the federal self-selected PIN.

- Complete the signature fields, including signing, dating, and providing the title of the authorized signer.

- Enter the six-digit E-File Identification Number (EFIN) and five-digit federal self-selected PIN for the Electronic Return Originator (ERO) in Part III.

- Once all fields are completed and verified, save the changes, and you may choose to download, print, or share the completed form.

Complete your PA PA-8879P online today to ensure compliance with Pennsylvania tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An Electronic Return Originator (ERO) begins the process of electronic submission of returns it either prepares or collects from taxpayers who want to e-file their returns. An ERO starts the electronic submission of a return after the taxpayer authorizes the filing of the return via IRS e-file.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.