Loading

Get Irs 1099-k 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-K online

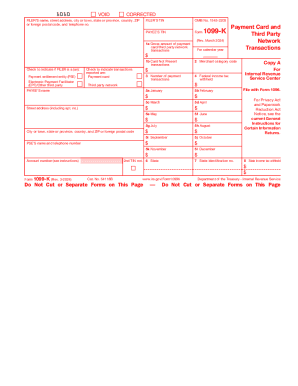

The IRS 1099-K form is essential for reporting payment card and third-party network transactions. This guide provides a detailed, step-by-step approach for users to fill out the form accurately online, ensuring compliance with IRS requirements.

Follow the steps to complete your IRS 1099-K online.

- Press the ‘Get Form’ button to access the IRS 1099-K form and open it in your document editor.

- Enter the filer’s name, address, and telephone number in the designated fields at the top of the form. This information identifies the entity reporting the transactions.

- Provide the filer’s TIN in the specified field. This is essential for accurately linking the form to the correct taxpayer.

- Fill in the payee’s TIN in the corresponding area, ensuring that you provide the correct identifying number for the recipient.

- Record the gross amount of payment card or third-party network transactions in Box 1a. This should be the total amount for the calendar year.

- If applicable, indicate the amount of card-not-present transactions in Box 1b, which refers to transactions completed without the physical card, such as online sales.

- Specify the merchant category code in Box 2, which depicts the type of services or goods provided.

- Enter the total number of payment transactions in Box 3. Be sure to exclude any refund transactions.

- If federal income tax was withheld, list this amount in Box 4.

- Boxes 5a to 5l require the entry of the gross amount of transactions for each month of the calendar year, from January to December.

- If any state income tax was withheld, record this in Boxes 6 to 8 as needed.

- Review all entries for accuracy. Once confirmed, save changes to your form and download, print, or share it as necessary.

Complete your IRS 1099-K form online today to ensure timely and accurate filing.

Whether you own a business, are self-employed, work in the gig economy or are selling personal items, Form 1099-K includes the gross amount of all payment transactions. You may receive a Form 1099-K from each payment settlement entity from which you received payments in settlement of reportable payment transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.