Loading

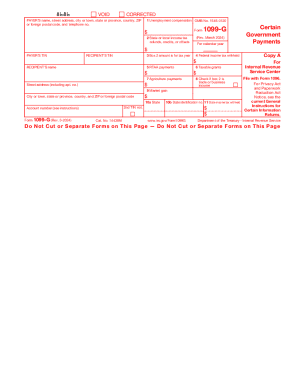

Get Form 1099-g (rev. March 2024)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1099-G (Rev. March 2024) online

Filling out the Form 1099-G is essential for reporting various government payments you may have received during the tax year. This guide will provide you with a clear and systematic approach to complete the form online, ensuring that you understand each section as you go.

Follow the steps to complete your Form 1099-G online effectively.

- Press the 'Get Form' button to access the online version of Form 1099-G. This form will open in your browser for you to complete.

- Fill in the payer's name, street address, city or town, state or province, country, ZIP code, and telephone number in the designated fields at the top of the form.

- Enter the payer's taxpayer identification number (TIN) in the appropriate section, ensuring accuracy as this information is vital for reporting.

- Next, provide the recipient's name and TIN, ensuring that the details match official records to avoid processing issues.

- Indicate the total amount of unemployment compensation paid to the recipient in Box 1. Verify that this amount is consistent with any other documentation you might have.

- If applicable, enter any state or local income tax refunds, credits, or offsets in Box 2. Refer to past relevant tax filings to ensure historical accuracy.

- Complete Box 4 by indicating any federal income tax withheld. This reflects any amounts that were deducted and reported during the tax year.

- Continue by filling in any other relevant amounts in Boxes 5 through 9, including RTAA payments, taxable grants, agricultural payments, and market gains.

- If applicable, check the box in Step 8 to indicate whether the amount in Box 2 is from trade or business income.

- Review all filled-in sections for accuracy and completeness before proceeding to save your document. You can download, print, or share the completed form as necessary.

Complete your Form 1099-G online today to ensure accurate tax reporting and compliance.

Call us at 503-947-1488 Choose your language, and then press option 2 for Frances Online support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.