Loading

Get Swbc Excess Flood Insurance Application 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SWBC Excess Flood Insurance Application online

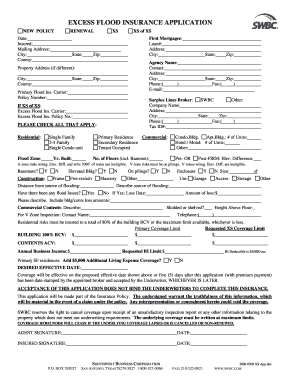

The SWBC Excess Flood Insurance Application is essential for obtaining flood insurance coverage beyond primary limits. This guide provides clear, step-by-step instructions to help you complete the application efficiently and accurately online.

Follow the steps to complete the application with ease

- Press the ‘Get Form’ button to obtain the application form and open it in your chosen editor.

- Fill in the date of application. Ensure that you accurately record the date on which you are completing the form.

- Provide the insured's name and mailing address, including city, county, and state.

- Indicate information regarding the first mortgagee, including their name, loan number, address, city, and zip code.

- Complete the agency information, including the agency's name, contact person, address, city, phone number, and email.

- If the property address differs from the mailing address, input it in the designated fields along with the state, city, county, and zip code.

- List your primary flood insurance carrier along with your policy number.

- Check the applicable boxes under property types and occupancy status, including single-family, multi-family units, condos, primary residence, commercial properties, secondary residences, or tenant-occupied situations.

- Provide the year built and flood zone information for the property.

- Complete the section regarding the SWBC surplus lines broker, including the company name, address, city, phone number, and tax ID number.

- If applicable, provide details about excess flood insurance coverage, including the name of the excess flood insurance carrier and the policy number.

- Specify the construction type of the building and details pertaining to its elevation, including whether it has a basement.

- Detail any previous flood losses, including loss date and amount. If applicable, provide a description of the source of flooding and any commercial contents affected.

- Indicate the requested excess coverage limit as well as any primary coverage limits, including building replacement cost value and contents actual cash value.

- Select whether you desire additional living expense coverage and state the desired effective date for the coverage.

- Sign and date the form at the bottom. Ensure both the agent and the insured provide signatures.

- Once all fields are completed, save your changes. You can then download, print, or share the completed application as needed.

Complete your SWBC Excess Flood Insurance Application online today to ensure your property is protected.

To file an insurance claim for flooding, start by gathering all relevant information about the incident, including photos and documents of the damage. Contact your insurance provider to report the claim and fill out the necessary forms, such as the SWBC Excess Flood Insurance Application. Make sure to keep copies of all documentation you submit, as this helps streamline the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.