Loading

Get This Agreement Is Between The Credit Union Member (designated As You, Your) And Unified

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Agreement Is Between The Credit Union Member (designated As You, Your) And Unified online

This guide provides a comprehensive overview of how to effectively complete the agreement between you, the credit union member, and Unified Communities Federal Credit Union. Follow these clear steps to ensure your electronic funds transfer agreement is completed accurately and efficiently.

Follow the steps to complete your agreement online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

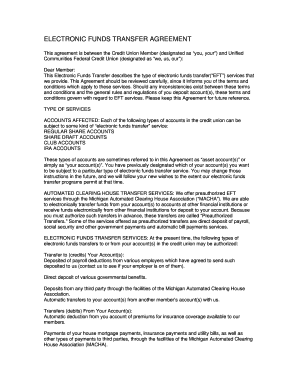

- Review the introductory section of the agreement carefully. This section outlines the purpose of the agreement and the relationship between you and Unified. Ensure you understand the terms and conditions that apply to the electronic funds transfer services discussed.

- Identify and mark the types of accounts affected by the electronic funds transfer services. These might include regular share accounts, share draft accounts, club accounts, and IRA accounts. Confirm which of these accounts you wish to designate for electronic fund transfers.

- Proceed to the section detailing the automated clearing house transfer services. Review the different preauthorized transfer options available, such as direct deposits and automatic bill payments. You may need to indicate your preferences accordingly.

- Fill out your preferences for specific electronic funds transfer services. Indicate how you wish to manage deposits and withdrawals from your accounts, including any transfers to or from your account(s).

- If applicable, read through the section on transaction limits and minimum balance requirements. Acknowledge your understanding of the limitations on transfers and potential charges associated with the services.

- Complete the rights and responsibilities section to understand your obligations and the credit union's responsibilities regarding electronic funds transfers. This is crucial for protecting your rights as a member.

- At the end of the form, save your changes. You will have the option to download, print, or share the document. Ensure you keep a copy for your records.

Complete your agreement online today to enjoy seamless electronic funds transfer services.

At credit unions, depositors are called members. Each member is an owner of the credit union. Banks depositors are called customers. Customers have no ownership in the financial institution, the financial institutions are owned by investors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.