Loading

Get Sc Initial Consumer Grantor Notification 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Initial Consumer Grantor Notification online

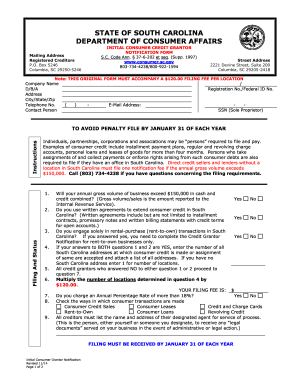

Filing the SC Initial Consumer Grantor Notification is an essential process for entities that extend consumer credit in South Carolina. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the SC Initial Consumer Grantor Notification form online.

- Press the ‘Get Form’ button to access the SC Initial Consumer Grantor Notification form and open it in your preferred online editor.

- Begin by entering your company name, doing business as (D/B/A) name, and address, including city, state, and zip code. Ensure all information is accurate and complete.

- Provide your telephone number and the name of a contact person for any inquiries related to this filing.

- Fill in the registration number or federal ID number, if applicable. This information identifies your business for government records.

- Enter your email address to receive confirmations or additional correspondence about your application.

- If you are a sole proprietor, provide your social security number as required.

- Answer the questions regarding your annual gross volume of business to determine if you exceed the $150,000 threshold. Select 'Yes' or 'No' as appropriate.

- Indicate if you use written agreements to extend consumer credit in South Carolina. This includes contracts and billing statements.

- If engaged solely in rental-purchase transactions, complete the section as instructed. Otherwise, follow the subsequent prompts.

- Calculate your filing fee based on the number of locations where consumer credit is extended, multiplying the number of locations by $120.

- Select the types of consumer transactions your business engages in, such as consumer credit sales or loans, by checking the relevant boxes.

- Designate a registered agent for service of process by providing their name and address.

- Review all entries for accuracy before submitting your application to avoid any delays or penalties.

- Finally, save changes to your form, and once you have reviewed everything, download or print a copy for your records. Share the completed form as required.

Complete your SC Initial Consumer Grantor Notification online today to ensure timely compliance.

To add a note to your credit file, you should contact the credit bureaus and follow their specified procedures, which could involve writing a statement. This note will be included in your credit report for lenders to see. The SC Initial Consumer Grantor Notification can aid in this process, as it provides a formal way of communicating important details about your credit history and intentions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.