Get Sc Berkeley County Application Special Assessment 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Berkeley County Application Special Assessment online

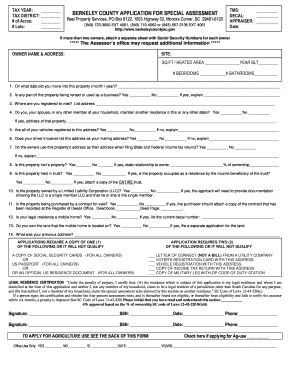

Completing the SC Berkeley County Application for Special Assessment online can facilitate a smooth and efficient submission process. This guide aims to provide clear, step-by-step instructions to assist users in navigating each section of the form.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to obtain the application form and open it for editing.

- Begin by entering the tax year and tax district in the designated fields. These are crucial for identifying the correct assessment period and corresponding district.

- Fill in the number of acres and lots associated with the property. This information helps determine property size and potential assessment implications.

- Provide the owner name and address. Ensure that the address matches the property's legal address for accuracy.

- Indicate the square footage and heated area of the property, along with the year it was built. Details about the number of bedrooms and bathrooms should also be included.

- Answer questions regarding property residency. This includes the date of moving in, rental status, voter registration address, and any additional residences held by household members.

- Identify whether this property is heir's property, held in a trust, or owned by a Limited Liability Corporation (LLC). If applicable, provide any required documentation as indicated on the form.

- Check the eligibility requirements for special assessment and provide necessary documentation such as social security cards or other accepted identification.

- Complete the legal residence certification section. This requires initialing that you have read and understood the penalty for providing false information.

- Ensure all required signatures are obtained and that the social security numbers are included where applicable.

- Review all provided information for accuracy, then save changes, download, print, or share the completed form as necessary.

Take action now by completing your SC Berkeley County Application Special Assessment online.

Seniors in South Carolina may not have a specific age at which they stop paying property taxes, but they may benefit from exemptions that reduce their tax liability. Applying for the SC Berkeley County Application Special Assessment can unveil options available to seniors, such as the legal residence exemption. Always stay informed about any changes in tax laws to ensure you're reaping the benefits. Knowing when to apply can lead to significant savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.