Loading

Get Pa Uc-2as 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA UC-2AS online

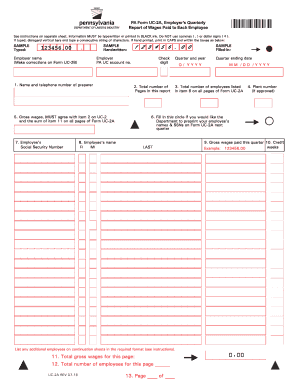

The PA UC-2AS is an important document for employers to report wages paid to employees. Understanding how to accurately fill out this form online is crucial for compliance and ensuring proper record-keeping.

Follow the steps to complete the PA UC-2AS online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the top section of the form, which requires basic information such as the employer identification number and reporting period. Ensure that your employer name and registration details are correctly entered.

- Proceed to the wage reporting section. Input the details of each employee. This includes their full name, social security number, and the total wages paid during the reporting period.

- Double-check all entries for accuracy. Ensure that there are no typographical errors, especially in numbers which could affect calculations.

- Navigate to any additional sections that may require specific attestations or compliance confirmations, as listed on the form.

- Once all information is entered and verified, save your changes to keep your progress secure. You may choose to download, print, or share the completed form as needed.

Complete your PA UC-2AS online to stay compliant and manage wage reporting effectively.

An unemployment compensation report is a document that provides details about an employer’s contributions to the unemployment compensation system. This report typically includes employee earnings and the total amount contributed to the UC fund. Submitting this report accurately is essential for maintaining compliance and supporting eligible employees during unemployment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.