Get Pa Phfa Appendix 9 2004-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PHFA Appendix 9 online

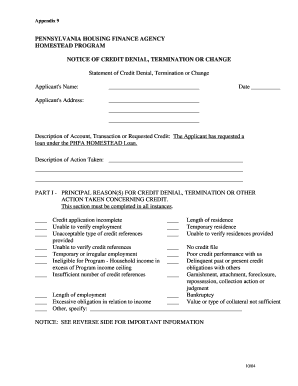

This guide provides a comprehensive overview of how to fill out the Pennsylvania Housing Finance Agency Appendix 9 online. Designed for users with varying levels of experience, this guide aims to facilitate a smooth and efficient completion of this important document.

Follow the steps to complete the PA PHFA Appendix 9 effectively.

- Press the ‘Get Form’ button to access the PA PHFA Appendix 9 and open it in the document editor.

- Begin by entering the applicant's name and address in the designated fields. Ensure that the information is accurate and matches any official documents.

- Fill in the date on which this form is being completed. This is typically the date of submission.

- In the section titled 'Description of Account, Transaction or Requested Credit', provide a brief summary of the loan requested under the PHFA Homestead Loan.

- In the 'Description of Action Taken' field, clarify the action that has been taken concerning the application's credit status.

- Move to Part I, which requires you to check all applicable principal reasons for credit denial, termination, or other action taken related to credit. Select the reasons that apply to your situation.

- If the credit decision was based on information obtained from an outside source, proceed to Part II. Provide the name, address, and telephone number of the reporting agency used.

- If applicable, fill in the details for any other outside sources that contributed to the credit decision, as outlined in Part II.

- Finally, ensure you have included contact details for the creditor and the Pennsylvania Housing Finance Agency should you have any further inquiries regarding this notice.

- After completing all sections, you have the option to save changes, download, print, or share the form as needed.

Complete your PA PHFA Appendix 9 online today to ensure timely processing!

The income limit for the first-time home buyer grant in Pennsylvania varies based on the size of your household and the county in which you are buying a home. Generally, to qualify, your income must not exceed 80% of the area median income. Referencing the PA PHFA Appendix 9 is key to understanding these thresholds. By knowing these limits, you can better position yourself to access available homebuyer assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.