Loading

Get Irs Form 668-a(c)(do) 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Form 668-A(c)(DO) online

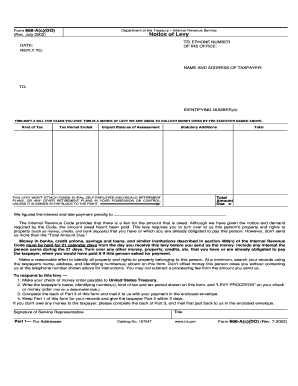

Filling out the IRS Form 668-A(c)(DO) online can seem complex, but with clear guidance, you can complete it efficiently. This form is a notice of levy used by the IRS to collect unpaid taxes, and it is crucial to understand its components for proper completion.

Follow the steps to fill out the form accurately.

- Use the ‘Get Form’ button to access the IRS Form 668-A(c)(DO) and open it in your preferred editor.

- Input the date in the designated field to indicate when the form is being completed.

- Provide the tax office's telephone number, which can be found at the top of the form.

- Fill in the name and address of the taxpayer for whom this levy notice is being issued.

- Enter the identifying numbers associated with the taxpayer to ensure accurate processing.

- Specify the type of tax, the tax period ended, the unpaid balance of assessment, statutory additions, and the total amount due.

- Review the section stating that funds in certain retirement plans will not be attached unless signed; check if applicable.

- Complete Part 3 of the form—acknowledge the levy with your signature and details of the levy results.

- After providing the necessary information, save any changes you've made, and prepare to download, print, or share the form.

Take the next step in managing your taxes by completing Form 668-A(c)(DO) online today.

Related links form

Except to the extent provided in section 6334(e), the principal residence (within the meaning of section 121) of the taxpayer and tangible personal property or real property (other than real property which is rented) used in the trade or business of an individual taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.