Get Or Ors 87.093 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR ORS 87.093 online

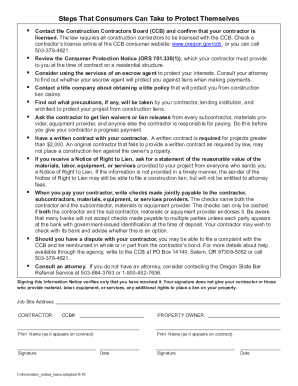

Filling out the OR ORS 87.093 form is a crucial step in understanding your rights and responsibilities regarding construction liens in Oregon. This guide aims to provide you with clear and detailed instructions on completing the form online, ensuring that you are well-informed and protected.

Follow the steps to fill out the OR ORS 87.093 form accurately.

- Press the ‘Get Form’ button to access the OR ORS 87.093 form and open it in your preferred editor.

- Carefully enter the job site address where the construction work is taking place. Ensure that the address is accurate to avoid any issues with the document's validity.

- Fill in the contractor's name and their construction contractor's board (CCB) number. Verify that this information matches what is legally registered.

- Next, provide your name as the property owner. Use the same name that appears on the contract for consistency.

- Sign the form to confirm you have received the information notice. Remember, your signature is merely an acknowledgment of receipt and does not grant additional rights regarding liens.

- Date your signature to ensure that there is a record of when you received the notice.

- Review all entered information for accuracy before finalizing your form.

- Once satisfied with the information provided, choose to save changes, download, print, or share the form as needed.

Complete your documents online today for better management of your construction processes.

To file a lien on property in Oregon, you need to prepare a lien claim that outlines the amount owed and the work performed. You will then submit this claim to the county clerk's office, adhering to the processes detailed in OR ORS 87.093. Documentation is key in this process, so keep copies of all relevant paperwork. Utilizing platforms like USLegalForms can streamline this process and ensure compliance with state regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.