Loading

Get Or B-37

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR B-37 online

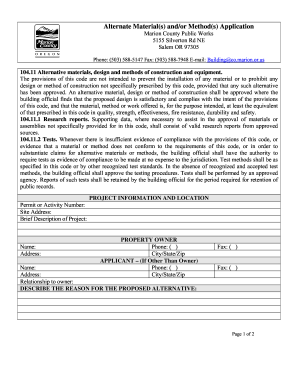

Filling out the OR B-37 form, associated with alternative materials and methods application, can seem daunting. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the OR B-37 form confidently.

- Press the ‘Get Form’ button to access the OR B-37 form and open it in your preferred application.

- Begin by entering the permit or activity number, site address, and a brief description of the project in the designated fields at the top of the form.

- Provide the contact details of the property owner including their name, address, phone number, and city/state/zip code.

- If the applicant is not the owner, fill in their details as requested, including name, address, phone number, city/state/zip code, and relationship to the owner.

- In the section titled 'Describe the reason for the proposed alternative', clearly explain the rationale for your application.

- Next, describe why and how the proposed alternative is equivalent to the code requirements regarding strength, effectiveness, fire resistance, durability, health, and safety.

- List any substantiating evidence, such as reports or studies, that support your application, and ensure to attach copies of any relevant documentation.

- Finally, sign and date the form to complete your application.

- Once you've filled out all sections, you may save your changes, download, print, or share the completed form as needed.

Take the first step and fill out your OR B-37 form online today.

When filing an estate tax return, it's essential to gather several documents. Key items include the death certificate, the will, and records of all assets and debts. Ensure you have the OR B-37 form on hand, as it will play a crucial role in your tax filing process, helping you comply accurately with regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.