Get Ok Sa&i 2643 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK SA&I 2643 online

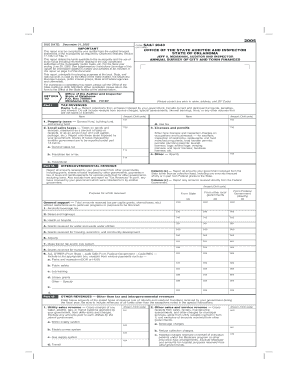

The OK SA&I 2643 form is a crucial document required for municipal financial reporting in Oklahoma. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently online, ensuring all necessary details are captured.

Follow the steps to fill out the OK SA&I 2643 form online.

- Click the ‘Get Form’ button to access the form and open it in an editing interface.

- Begin with Part I, where you will enter tax revenues. Provide amounts for property taxes, local sales taxes, and licenses. Make sure to omit cents in your entries.

- Continue to Part IA, where you report intergovernmental revenue. Detail the amounts received from the state and federal governments, ensuring you specify the purpose for which each amount was received.

- Move to Part IB and fill out other revenues. This area covers utility sales revenue, service charges, and miscellaneous other revenues. Include detailed descriptions as required.

- In Part II, provide direct expenditures by purpose and type. Categorize all expenditures according to the specified sections, ensuring that you include gross salaries and relevant operational costs.

- Proceed to Part III to report any intergovernmental expenditures made to other governments for various services.

- Complete Part IV by entering details related to salaries, wages, and force account expenditures.

- In Part V, report on debt outstanding, issued, and retired. Capture all long-term and short-term debt information as specified on the form.

- Finally, ensure all sections are completed accurately. Review your entries, make any necessary corrections, and save changes. Users can then download, print, or share the completed form as needed.

Complete your OK SA&I 2643 form online today to ensure timely and accurate reporting!

Get form

An assistant state auditor supports the state auditor by performing preliminary audits, collecting data, and preparing documentation based on guidelines like OK SA&I 2643. They help analyze financial statements to detect potential risks or inaccuracies and assist in drafting comprehensive audit reports. Their role is essential for maintaining the accuracy and integrity of financial information for state agencies. By contributing to this process, they help ensure fiscal responsibility in government operations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.